Episodes

Tuesday Nov 28, 2017

Tuesday Nov 28, 2017

These tips were submitted by John Livingston of www.PlethoraBusinesses.com - a past guest. You can find additional 1 minute tips and Show Highlights in the index.

"Selling your business can be a very difficult and emotional experience. The process can be made much easier by doing one thing----PREPARE. Identify your goals. What are the really important things you hope to accomplish? Getting maximum value is always a consideration, but what about employee retention or treatment of minority shareholders? How long are you willing to assist in the transition to new management? Are you willing to provide financing for part of the purchase price?"

"Once your goals are clearly defined, prepare the company for sale. Try to anticipate due diligence issues and deal with them prior to sale. Common areas that can create issues are inventory, accounts receivable and key employees"

ExitCoachRadio.com - Great Advice from Great Advisors!

Listen to Daily interviews and tell your Business Owner friends!

Friday Dec 12, 2014

Don't Let Your Holiday Party Bring You Down by Jeffrey Verdon

Friday Dec 12, 2014

Friday Dec 12, 2014

In a recent issue of Client Alert, we illustrated just how far the courts are going to hold the "deep pocket" responsible to pay damages even though he or she didn't cause them. We wrote about John Catsimatidis, a modern business hero and successful immigrant entrepreneur, being found personally liable for millions of dollars in damages because someone in his company was found to violate certain Federal employment laws (http://jmvlaw.com/protect-personal-assets/); so much for the notion that a corporation will shield its shareholders from personal liability.

Last year, I wrote about an even more alarming case, Purton vs. Marriott International, and given we are in the holiday party season, the case was worth repeating. The incident happened in December, 2009.

Jack Landri, a bartender at the Marriott del Mar Hotel, had a beer and a shot of whiskey at home before going to the company holiday party. Everyone at the party was given two tickets for wine or beer. No hard liquor like whiskey or tequila was served. However, Jack brought a flask with about five ounces of whiskey in it to the party. Not only did he finish his flask but the bartender at the party refilled it with whiskey from Marriott's supply. After three hours, Jack went home with some of his co-workers.

Later that night, after he arrived home from the party, he decided to drive his drunken co-worker home. Traveling at speeds in excess of 100 mph and a .16 blood alcohol level, Landri smashed into the car in front of him, driven by a young doctor named Jared Purton, killing him instantly.

Dr. Purton's parents sued Marriott for wrongful death. The hotel chain asked the trial court to dismiss the case, claiming that its responsibility ended when its employee arrived home safely after the party. The trial court agreed with Marriott and dismissed the case.

Dr. Purton's parents appealed the case. The California 4th District Appeals Court did not impose "respondeat superior" liability on Marriott as a matter of law. Rather, by reversing Marriott's summary judgment, the court remanded the case back to the trial court to determine whether the employee's decision to drive while intoxicated, even after returning home from an employer-sponsored event, was so unusual as to render the resulting accident as unforeseeable.

It all boils down to this: If you are an employer and host company parties, outings, BBQ's, or other employee appreciation events, you should rethink your alcohol consumption policy for your employees, because if there is an accident or injury, your company may have to pay up. Or, alternatively, assign a person to monitor the state of the employees before allowing them to leave the event and perhaps, even administer a breathalyzer test to meet the apparent burden of "foreseeability" by the employer. This trend to blame the business owner (deep pocket) for any bad behavior is disturbing. This case should be a "loud and clear" message to employers to change their practices, and to build "firewalls" around their company assets to protect against the liability claims that this case will surely bring.

If you are afraid that you could be a target for lawsuits and want to explore what steps can be taken to "level the playing field" against these kinds of claims, we might be able to help. Please call us for a complimentary consultation.

For more information about any of the information discussed in this Client

Alert, or any other income or estate tax planning or asset protection planning

assistance, please contact the: Jeffrey M. Verdon Law Group, LLP at jeff@jmvlaw.com or 949-263-1133.

Thursday Dec 04, 2014

Exiting Your Business Is A Process, Not A Mystery - Bill Black

Thursday Dec 04, 2014

Thursday Dec 04, 2014

Nora Chapman's story was typical of most business owners who have made the tough decision to leave their companies. At age 54, she was confident in finding a meaningful second act and was ready to leave her 25-employee advertising business. Nora was thinking of selling to one or two of her key employees and when we met her, her first question was: “Is this the right exit choice?”

Many of you find yourself in the same predicament. You are able to envision your life beyond business ownership, but you don’t have a clear picture of how best to “leave your business in style.” So what do you and the Nora Chapmans of the world do? Here is what we told Nora.

First, understand that leaving your company is a process. Realizing that life after your business exit can be as fulfilling as your life as a successful owner is simply the first step. The next step is to figure out a way to approach your exit in a methodical, logical, rational manner. Most owners do not put enough thought and planning into their exits because they don’t know how to begin, that there’s a process available to them, or exactly what issues to consider and analyze.

If that describes your situation, you are not alone. Most owners, and their advisors for that matter, don’t know that there is a planning and an implementation process that is methodical, rational and can be tailored to your unique exit goals. It is The Seven-Step Exit Planning Process™.

This Process begins with setting your exit objectives and understanding the value of your business. Based upon what you want and what you have, you can then examine and choose a proper path for you: be it a sale to a third party, a transfer to children, a sale to an ESOP, a sale to a co-owner, or an orderly liquidation. As part of this Process, you also must consider what would happen to the business and to your family in the event your death or disability precedes your planned exit.

Simply knowing the process and proceeding down the Exit Planning path, however, is insufficient. According to the Small Business Administration (SBA) most business owners who begin the planning process fail because they fail to plan. To pursue a successful path, you need a written plan that:

- Identifies your exit, financial and other objectives that must be considered; and

- Documents how you are going to achieve those objectives.

Along with this written plan you must have a checklist that:

- Assigns responsibility for each task to be completed throughout the Exit Planning process;

- Sets dates for each task to be completed; and

- Designates the person responsible for completing each task.

How do you begin?

“Let us, therefore, decide upon the goal and upon the way and not fail to find some experienced guide who has explored the region towards which we are advancing; for the conditions of this journey are different from those most travel.” — Seneca, “On the Happy Life” (AD 58)

As skilled and as successful as most business owners are, it can be difficult, working alone, to create and execute their Exit Plans. Rarely have owners made a career of exiting businesses. Those owners who do attempt to craft their own Exit Plans may end up leaving a lot on the table: a lot of money, time and/or their own happiness.

And, as skilled as is your attorney, CPA or financial and insurance representative, each may not be able to craft a successful Exit Plan alone. Successful Exit Planning is a multi-disciplinary effort that requires you and your advisors working together. No one profession covers all of the facets necessary to advise a business owner on the wide variety of Exit Planning issues.

For your Exit Plan to succeed, you need legal expertise, financial advice, tax planning, financial advisory input, and often, consulting ideas. If you decide to sell to a third party, you may require the services of a Business Broker or Investment Banker. You should not expect one advisor to be an expert in all aspects of exiting a business.

What does it take to create an Exit Plan?

- Understand that there is a proven Exit Planning process. Learn as much as you can before you make final decisions.

- Commit to see the process through—holding yourself and others accountable.

- Document your decisions and create a written plan.

- Hire an experienced team of professionals—attorney, CPA and financial or insurance representative (at a minimum) to help guide you through this process. These professionals should more than pay for themselves. If they cannot, you have the wrong team.

If you are to exit successfully, there is much to do. We can help by providing more detailed information on Exit Planning in general, and by giving you a sense of the time and resources this planning and implementation process will take.

One of the first steps you can take is to assess your Sellability Score by clicking on the link under the "ACT" column at www.exitcoachradio.com

Subsequent issues of The Exit Planning Review™ provide unbiased and advertising-free information about all aspects of Exit Planning. We have newsletter articles and detailed White Papers related to this and other Exit Planning topics. If you have any questions or want additional Exit Planning information, please contact us.

Saturday May 24, 2014

Eight Ways to Exit Your Company (article) Bill Black

Saturday May 24, 2014

Saturday May 24, 2014

Eight Ways to Exit Your Company<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" />

By Bill Black

According to Paul Simon, there are 50 ways to leave a lover. Not being as creative as Mr. Simon, we’ve only come up with eight ways for owners to leave their companies:

Transfer the company to a family member; Sell the business toRead the rest of this entry »

Friday May 16, 2014

(Special) Jordan Walker Update - Bill Black

Friday May 16, 2014

Friday May 16, 2014

Jordan Walker is 16 years old. He suffered a major spinal cord injury on 11-22-13 at his High School playoff football game in the 1st quarter. He immediately lost all movement and sensation from his neck down. Follow the amazing daily story about Jordan and his parent's road to recovery at http://www.gofundme.com/5m7mms It is truly amazing, heartwarming and shows the lengths that devoted parents will go to for the love of their child.

Saturday May 10, 2014

Exit Planning Pays Long-Term Dividends - Bill Black

Saturday May 10, 2014

Saturday May 10, 2014

When we talk to business owners about the value of Exit Planning, we are talking about orchestrating a business exit that fulfills their unique financial and personal goals. Since tackling a task of this magnitude can be daunting, owners sometimes ask whether devoting the necessary time and money to this project is really worthwhile.

To answer that question, we’ve asked Kevin Short, an investment banker who works every day with owners of small and mid-sized companies, about the value of Exit Planning.

“Good exit planning can be the difference between a successful closing and a complete derailment of the sale process,” says Short.

When asked to explain, Short focuses on Steps 1, 2 and 3. “When an owner sets his objectives in an Exit Planning context (Step 1), he or she does so methodically and proactively. Owners who wait until entering the M&A arena to decide how much cash they want and need from their companies do so reactively and often are blinded by attractive bait held out by less-than scrupulous buyers.”

In Step 2 of the Exit Planning Process, owners and their advisors place a value on the owner’s company. “When an owner’s first valuation experience happens in my office, and that owner is primed and ready to sell last Friday, learning that the company is not worth what he or she had hoped is a painful experience. Even more painful is the subsequent rededication of effort to building the value of the company.”

In Short’s opinion, “The element of Exit Planning that gives an owner the biggest bang for the buck is, without a doubt, Step 3 of The Exit Planning Process (Build and Preserve Value).”

One technique that exit planners use to motivate managers to remain with a company post-closing (a vital Value Driver) is the Stay Bonus. An effective Stay Bonus accomplishes three tasks: 1) it gives the key managers a reason to stay; 2) it is structured so that it increases the value of the company, and 3) it includes a penalty (usually in the form of a covenant not to compete) that prevents key managers from taking key clients, vendors or trade secrets with them should they leave before or after the sale.

Short can rattle off far too many horror stories about owners who, believing that their loyal employees were happy and already well compensated, were held hostage by those same employees.

In one, Kevin describes an owner who was a week away from the sale of his company for $10 million. “At this very late stage of the game, the buyer met with each of the key managers to reassure them that they’d be retained by the new owners at their existing compensation levels. At its meeting with my client’s top salesperson, it was lavish in its praise about her performance and about how important her continued success was to the company’s future success. When the buyer asked her to sign a covenant not to compete before the closing date, the salesperson asked for a break and headed straight for my client’s office. She proceeded to remind my client that she’d helped build the company to its current value during her tenure, and ever-so-generously consented to wait until the closing date to collect her $1 million bonus.”

“My client paid the ransom. He understood that if the salesperson servicing his top four clients left the company, the buyer would likely scrap the deal. If the buyer did come to the closing table, it would reduce its purchase offer by far more than $1 million.”

As a result of this and many similar experiences, “We recommend that owners get very aggressive implementing Stay Bonuses with anyone who has a significant impact on a company’s performance.” Short elaborates, “The Stay Bonus should apply to anyone—and that might be the janitor—whose cousin is your biggest client—who has leverage against the company.” And, of course, tie the stay bonus to a covenant not to compete (or similar agreement), first checking with your attorney about how to best create enforceable agreements.

In Step 3, advisors also work with owners to protect business value. One method is to clean up shareholder agreements (again, well in advance of any contemplated sale or transfer). “If a shareholder agreement does not force a minority shareholder to sell when the majority shareholder does, majority owners can (and often do) find themselves unable to sell, or held hostage by minority shareholders.”

“By and large,” adds Short, “entrepreneurs ignore both Stay Bonus Plans and shareholder agreements because they believe that other shareholders or employees will ‘come along’ on closing day.” Short observes, “What owners forget is that every shareholder and every employee figures out leverage and most intend to use it.”

From these and many other examples from his practice, Short believes that Exit Planning is indeed well worth the time and money owners devote to it. If you’d like to learn how exit planning might save you time and money, please contact us.

Friday May 02, 2014

7 Powerful Ratios To Start Tracking Now - Bill Black

Friday May 02, 2014

Friday May 02, 2014

Doctors in the developing world measure their progress not by the aggregate number of children who die in childbirth but by the infant mortality rate, a ratio of the number of births to deaths. Similarly, baseball’s leadoff batters measure their “on-base percentage” – the number of times they get on base as a percentage of the number of times they get the chance to try.

Acquirers also like tracking ratios and the more ratios you can provide a potential buyer

Saturday Apr 26, 2014

Saturday Apr 26, 2014

By Bill Black<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" />

One

of the biggest factors in determining the value of your company is the extent

to which an acquirer can see where your sales will come from in the future. If

you’re in a business that starts from scratch each month, the value of your

company will be lower than if you can demonstrate the source or sources of your

future revenue. A recurring revenue stream acts like a powerful pair of

Sunday Apr 20, 2014

Sunday Apr 20, 2014

Spring is a time for new beginnings and renewal.

Don't be chained to your past thoughts ... get new ideas and act on them.

Start preparing now for the inevitable day when you will Exit your business (voluntarily or otherwise!)

Finish the race strong by understanding the course.

We'll help you with daily 1 minute tips, ideas and precautions from over 250 business advisors.

Because you, the Private Business Owner, are our Hero!

Happy Easter from Bill Black and ExitCoachRadio.com!

ExitCoachRadio.com ... Come Listen for a Minute!

Wednesday Apr 16, 2014

The Necessary Beast: Due Diligence (Article) Bill Black

Wednesday Apr 16, 2014

Wednesday Apr 16, 2014

No experienced buyer purchases a company without first learning everything

there is to know about it. That learning process is known as “due diligence.”

Sunday Apr 13, 2014

(Article) Wise Words from Nick Faldo

Sunday Apr 13, 2014

Sunday Apr 13, 2014

It's Masters' Sunday!

Nick Faldo, 3 time Champion, shared wise words that you can pass on during his tribute.

When talking to a grade school class, he recited the alphabet's first 4 letters: A, B, C, D.

He told the kids to reverse the letters and remember that they stand for:

D Dream

C Create

B Believe

A Activate

Join us at ExitCoachRadio.com for more wise words from over 250 Advisors.

Daily 1 minute Tips and Ideas for age 50+ business owners.

ExitCoachRadio.com ... Come Listen for a Minute!

Saturday Apr 12, 2014

WEEKEND UPDATE - PLEASE SHARE WITH YOUR FRIENDS AND CONTACTS!

Saturday Apr 12, 2014

Saturday Apr 12, 2014

April 12, 2014

Our April 9 show was once again the source of a wealth of knowledge. We learned the basic building blocks of planning (including the importance of starting your planning by getting time back into your schedule) from Joe Siecinski of Action Coach (has been uploaded) ...

We heard about the most common legal questions that Attorney and SCORE OC volunteer Elissa Warantz gets from business owners, and she gave us a great primer on Business Law basics (has been uploaded) ... we learned from Strategic Business Advisor Ruth Smisko about the variety of benefits that a strategic advisor can bring to a business owner (has been uploaded) ... also learned from Peter Meyers from Farmers & Merchants Bank about the Post-Great Recession different banking environment and how to get the most of it (will be uploaded Sunday) ...

Heard some great planning tips from Sandy Lowengart of Capital Trust Advisors about how to create an income-producing investment portfolio (will upload Monday)...then Chris Scully from Practical Business Solutions talked to us about different strategies for exiting or transitioning from a business (including preparing to wind down and liquidate if it's your best option (will be up Tuesday)...they we heard from 4 past guests, Chuck Kiskaden about the current state of the Affordable Heath Care Act and what you should be asking your Broker; Aaron Weiner of Bailes Real Estate about the current business real estate leasing environment; (their updates will be uploaded Wednesday) Peter Tentler commented on the current state of Reverse Mortgages, and Chris Miles updated us on Cash Flow preparation for your retirement portfolio (upload will occur Thursday).

No time to rest -- we have another great lineup to prepare for next Wednesday, which will include Action Coach Lizette Mandela, SCORE Mentor Carl Woodard on "Writing a Business Plan"; John Foley of Arrow Up Partners, M&A expert Jed Davis, Attorney Harriet Alexson, Lauraine Bifulco, Asset Protection Attorney Rodney Hatley and Devon Blaine from the Blaine Group will share ideas on Increasing the Value of Your Business with Marketing Communication Strategies..

In the meanwhile, last week we were picked up for syndication by 4 new stations and we are looking forward to edu-taining the audiences of

I95 Sports Net Radio in New Jersey

WLEM in Pennsylvania

IGLU Internet Radio (app on iTunes and Stitcher)

High Country Radio

WATA WECR-FM WMMY WZJS WXIT WECR-AM

goblueridge.net

Thanks to these new Syndication Partners and Welcome to the Exit Coach Radio Community!

Thanks for listening and thanks for sharing!

Bill Black, Chief Cook & Bottle Washer

www.ExitCoachRadio.com is a great place to find daily 1 minute tips and ideas about Growing, Protecting and Preparing your Business for the future.

Every week 8 Professional Advisors, like Accountants, Attorneys, Business Brokers, Valuation Experts, Financial Advisors and others are interviewed.

And every day one of their interviews is uploaded to www.ExitCoachRadio.com along with several 1 minute highlights from current and past Guests.

The info is all indexed into file folders by Topic and Advisor name so you can really go deep on a topic.

And you can listen on your mobile device -- just enter www.ExitCoachRadio.com and it will take you to the mobile app for your phone.

http://iTunes.ExitCoachRadio.com is also available! Come Listen for a Minute -- and share it with YOUR friends!

Click for FREE E-book "100 Words from 20 Advisors"

How Ready Is Your Business for Transfer or Sale?

Click for FREE Assessment Report

"Come Listen for a Minute"!

Tuesday Apr 08, 2014

(Article) Adam Grant - Protect Your Mobile and Online Data

Tuesday Apr 08, 2014

Tuesday Apr 08, 2014

Mobile App and Online Privacy laws are constantly evolving to keep up with the rapid development of technology. Here are some tips from Adam Grant of Alpert, Barr and Grant, APLC to help you grow and protect yourself and your business:

- Optimize your company’s mobile capability. – Approximately 75% of all internet searches today are done from a mobile device, make sure your company’s information is “mobile-ready”.

- Maximize the value of your website. – Imparting information is great, but receiving information back is helpful in growing your business. Do it legally by having the proper disclosures in place.

- Consult with professionals. – Make sure you stay in compliance and are covered for every eventuality, be it with the proper legal privacy notices or the appropriate insurance coverage for you and your company.

For more information, contact Adam Grant at 818-827-5155.

Monday Apr 07, 2014

Listeners Are Saying The Nicest Things!

Monday Apr 07, 2014

Monday Apr 07, 2014

Thanks to all of you who have left a review on iTunes -- it really helps us get the word out because iTunes ranks Podcasts based on having a steady stream of new reviews.

To leave YOUR review. please go to http://iTunes.ExitCoachRadio.com , then click "go to iTunes" and log into your account. Thanks!

Comments from iTunes listeners

««««« Excellent resource - real value add for those looking to transition from their existing business and general great discussions with business owners. A new addition to my podcast listening!

««««« Great info - I love it, great info for business owners. So much crap that business owners have to deal with on a nonstop basis. I can't begin to tell you how insightful the show is for the issues that we deal with. It's a juggernaut. Thanks Bill for doing the show!

««««« Love the quick tips

-

Thursday Apr 03, 2014

(Article) Tim Templeton - Expand Your Word of Mouth and Get More Business

Thursday Apr 03, 2014

Thursday Apr 03, 2014

Tim Templeton, the founder and President of Templeton Interactive talks about an important way for businesses to expand their word of mouth and get more business: content marketing strategies including using social media and today’s blogging tools.

Tim shares a few simple tips for

getting the message out and expanding a business’ presence. Busy people

and smaller companies in particular can launch their own great content

marketing strategy using modern tools, to grab a prospect’s attention and bring

in new business.

https://www.linkedin.com/today/post/article/20140403191906-252568-the-two-most-misunderstood-platforms-on-the-web

Thursday Mar 27, 2014

(Article) Michael Wittick - Replace The Government's Plan?

Thursday Mar 27, 2014

Thursday Mar 27, 2014

How would you plan for everyone that you loved and everything you owned if you knew that you could replace the government’s plan, which is super expensive and ridiculously time consuming?

First, you would need a certified specialist counseling oriented estate planning attorney to plan your estate. Second, you should establish a formal regular updating program. Third, you should consider hiring a specialist to manage your financial planning, taxes, and insurance.

Take a look at witticklaw.com or call Michael J Wittick at 949-858-5970 for a free consultation by a certified specialist in estate planning, trust and probate law, AV Preeminent rated by his peers, with 30 years of experience.

Saturday Mar 22, 2014

(Article) Stacey McKibbin - Measure Your Way to Success By Using KPIs

Saturday Mar 22, 2014

Saturday Mar 22, 2014

Measure Your Way to Success By Using KPIs

By Stacey McKibbin

One of the things I enjoy about watching a

good football game is the commentator’s use of statistics.

I’m amazed by the wide range of statistics used and the conclusions drawn in

the commentator’s analysis of the game. Statistics, in many ways, really tell

the story of how

Sunday Mar 16, 2014

(Article) Bill Black - 5 “strategic” ways to sell your company

Sunday Mar 16, 2014

Sunday Mar 16, 2014

Click for FREE E-book "100 Words from 20 Advisors"

How Ready Is Your Business for Transfer or Sale? Click for FREE Assessment Report

Did you see the news that Facebook has

recently acquired Internet messaging service WhatsApp for $19 billion? It

represents the largest-ever acquisition of an Internet company in history.

Saturday Mar 15, 2014

(Article) Bill Black - Is Your Business You-Proof?

Saturday Mar 15, 2014

Saturday Mar 15, 2014

Click for FREE E-book "100 Words from 20 Advisors"

How Ready Is Your Business for Transfer or Sale? Click for FREE Assessment Report

IS YOUR BUSINESS “YOU-PROOF”?

By Bill Black, Certified Exit Planner

Whether you’re planning to sell your company sometime soon or sometime in the future; now is the time to ensure that your business isn’t all about you. From the latest Sellability Score* research involving 2300 companies from around the globe, here are two key factors

Thursday Mar 13, 2014

(Article) Peter Meyers - Business Lending Issue – Solved!

Thursday Mar 13, 2014

Thursday Mar 13, 2014

When

entrepreneurs seek working capital or equipment loans and lines of credit from

banks, personal guarantees are regularly required to ensure that the business

owner has “skin in the game” and to mitigate risk. However the Great Recession

crushed the

Thursday Mar 06, 2014

(Article) Living With Your Buy/Sell Agreement - Bill Black

Thursday Mar 06, 2014

Thursday Mar 06, 2014

In a previous article, we looked at what happens to a company when one owner becomes disabled. In our example, the company had a buy-sell agreement that covered the death of an owner, but failed to adequately address the cash flow implications of a lifetime event (divorce, disability, bankruptcy or retirement of a shareholder).

Few owners (or their advisors) give much thought or analysis to the

likelihood of a lifetime transfer. Instead they focus all of their attention on

dealing with the least likely event—an owner’s death. Yet, in our experience,

lifetime transfers occur much more frequently, and when they do can cause huge

problems.

Wednesday Mar 05, 2014

Wednesday Mar 05, 2014

6 little things that make a big difference to the value of your company<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" />

With the Sochi Olympic Games that took place last month, it is interesting to reflect back on some of the big events of the 2014 Olympic Games.

In

Bobsledding The Russians edged out Latvia and the

United States, who finished second and third, with an overall time just .09

seconds better than Latvia. Zbigniew Brodka of Poland won the Men’s 1500m

Speed Skating by .003 seconds, and the

Men’s 1000m Speed Skating was won by only 0.04 seconds.

Tuesday Mar 04, 2014

(Article) Elements of a Plan to Sell to Insiders - Bill Black

Tuesday Mar 04, 2014

Tuesday Mar 04, 2014

Today

we discuss the essential elements of a plan owners use to transfer a business

to insiders (with the help of skilled advisors) that keeps the owner in control

until he or she is paid the sale price. If you suspect that the children, key

employees or co-owners you would pick to succeed you do not have the funds to

cash you out, consider the following 10 elements that make insider transfers

successful.

Monday Mar 03, 2014

Monday Mar 03, 2014

Numbers are black and white right? Not

really. When you hire an investment

banker to sell your business, they "normalize" the company's numbers to present the best

version of financial performance. What do they look for, and what can you do in

advance to help the sales

process? In this article, we identify the top 10 EBITDA adjustments, so you can have a better

chance at selling your company at the highest price.

Sunday Mar 02, 2014

Sunday Mar 02, 2014

After initial interviews sales people want to prepare “solutions” for their prospective clients. The sales person heard clients’ articulate goals, concerns and possibly expectations for their next steps. What question do YOU ask in situations like this?

Does it sound like – “what presentation should I use? What other situations were similar so I can prepare a presentation? What should I concentrate on for my presentation? What financial model should I use?

Or, should you reflect – “what has prevented these people from solving this problem before? If I were the client selling our solution upstream to other decision makers/team members; what information would I require to accomplish my sale to someone else? Just remember, it is NOT about you.

Saturday Mar 01, 2014

Saturday Mar 01, 2014

A great question for the business owner is – “what is most important; having an “A” level plan with “B” level execution, or, a “B” level plan with “A” level execution?” This can lead to a great discussion, yet, is it the right question? What if you approach your planning to make sure where you KNEW there was passion for execution at the “A” level and then built an “A” level plan. The right question – How do we get an “A” level plan with “A” level execution? Not accepting anything but an A-GAME leads to excellence and market differentiation. Invest time to ask the right question.

When your sales people are selling – do they ask the right question(s)? Are the questions asked so the salesperson can discover information – or, are the questions asked so the clients can discover clarity?

Friday Feb 28, 2014

Friday Feb 28, 2014

Business owners constantly look to improve their business –

they look to improve the health of their company. How many questions do they consider as they

look to understand how to improve their business?

How do clients KNOW that they are investigating the right

options when they ask the question to start the process? Business owners are easily challenged because

business owners are busy, they are confident and they love solving

problems. With the speed of business

they consider a question – call on life experience and information readily

available and they are “doers”.

Business owners act quickly once they have a feel that they

can improve their business and the results.

Just consider for a moment - What if the initial question is

the wrong question? What if the question

asked is focus too narrowly or is focus on only short-term improvements? What if the question doesn’t consider

long-term succession planning issues?

How does the action impact the long-term is challenging if you don’t

have the goals clarified for the long-term?

Thursday Feb 27, 2014

(Article) 6 Ways You Can Make Your Company A Learning Organization - Bill Black

Thursday Feb 27, 2014

Thursday Feb 27, 2014

6 Ways You Can Make Your Company A Learning Organization<?xml:namespace prefix = "o" ns = "urn:schemas-microsoft-com:office:office" />

I’m not a big fan of buzzwords. I also have to admit there are times where they actually become useful. The problem with this particular one, “learning organization” is that it’s often misused.

I do believe that if you really

want your company to get better, it needs to be a learning organization.

At the same time, just saying you have one doesn’t make it true. Here are

6 things you might want to think about if you’re really serious about

Sunday Feb 23, 2014

Sunday Feb 23, 2014

Are you thinking about selling your business, but you’re not really sure where to start? Do you have an exit strategy in place?

Selling a business is not as easy as selling a house. With a house you know what you’re selling - 3 bedrooms, 2 bathrooms, with a great view, in a popular location. There are probably several similar homes in the local neighborhood that you can look at for comparison and you can always call on the expertise of your local realtor, when considering a potential sale price.

When selling your business, it’s difficult to gauge exactly what you are selling. You may ask yourself: is my company valuable? Is my business sellable?

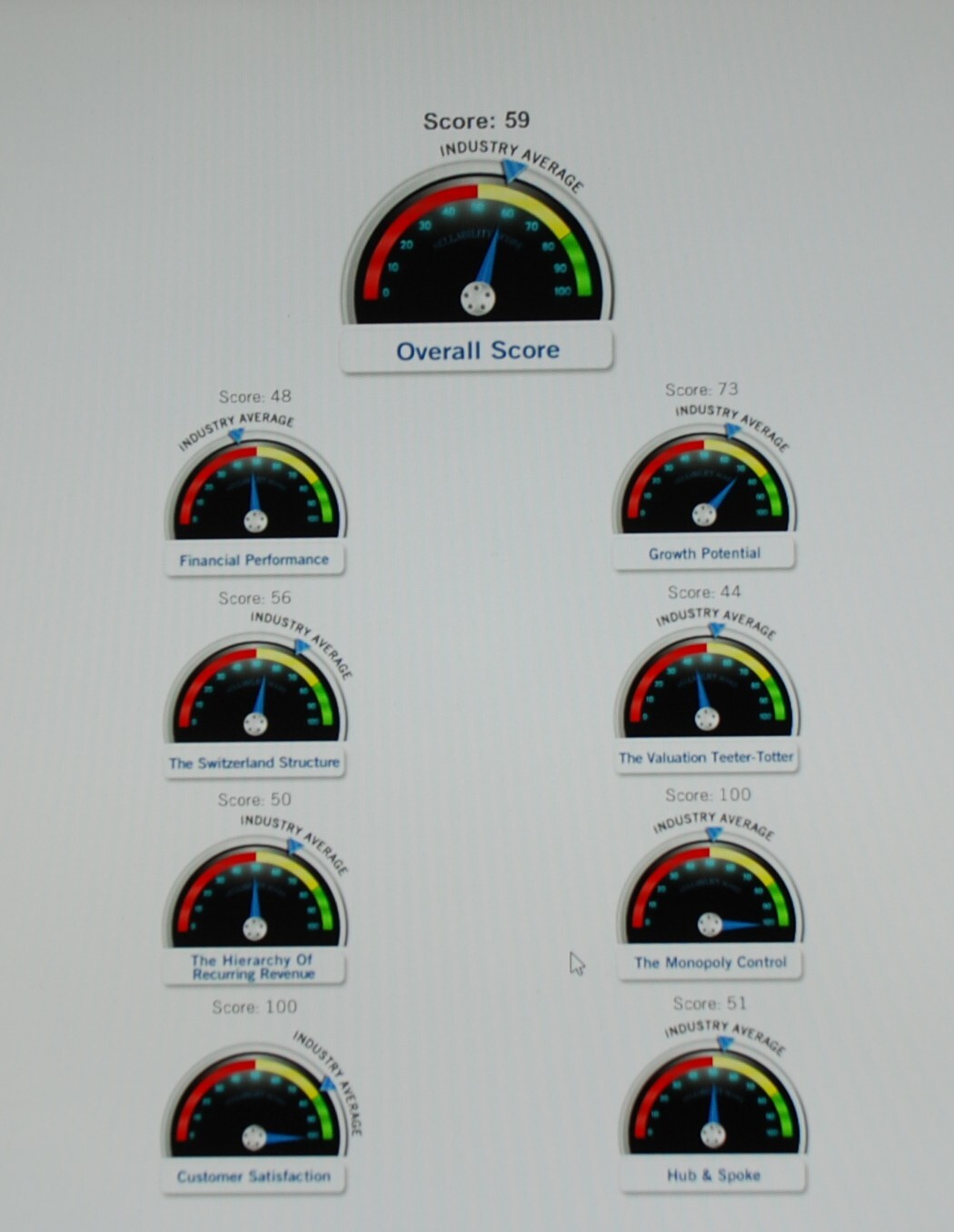

Your Sellability Score reveals how “sellable” your business is and predicts the likelihood you’ll get a premium over industry average multiples when you’re ready to sell.

The Sellability Score can assist you in answering these questions. This online tool has been developed by best selling author John Warrillow, whose work includes “Built to Sell: How to Create A Business That Can Thrive Without You”.

You simply complete a brief online questionnaire to receive an immediate Sellability Score of between 1 and 100 for your business. You will also receive a 26 page report full of charts and graphs that will give you insights into how buyers evaluate your business.

In just 13 minutes, this absolutely free and confidential self-assessment tool will score your business in a number of key areas and tell you just how sellable your business is.

Put a value on your business using the same methodology company acquirers use and discover how to increase the price you’ll get for your business.

Pinpoint the areas in your business that need improvement in order to maximize the value of your company.

You may not even be considering selling your business at this point; however completing the Sellability Score can help you to plan your exit strategy effectively. It can assist you to build/grow your business in such a way that, when the time comes to sell, your Sellability is maximized to its full potential.

Click here to Get YOUR Sellability Score

Saturday Feb 22, 2014

(Article) 5 Reasons You Need To Spend 20% Of Your Time Marketing - Bill Black

Saturday Feb 22, 2014

Saturday Feb 22, 2014

5 Reasons You Need To Spend 20% Of Your Time Marketing - Bill Black

OK, it might not be exactly 20% of your

time, but it will be at least that much if you want to have a continual source

of revenue. One of the big problems you have when you run a small

business is that there are dry spells of not having enough new business to

service.

This problem is caused by a

very simple issue. You haven’t been consistently selling your products or

services. There’s no secret to creating a stream of new business.

You just have to make enough sales calls and voila, new sales appear.

Whether you have a sales

department or not the key is to have a consistent sales effort. Lumpy

sales come from selling then servicing then selling again. You need to

develop a way to both sell and service at the same time. If your company

is small, you need to set time aside for this activity. If your company

is larger and you have a sales staff you need to manage their activity.

The easy part is knowing what

you have to do. The hard part is knowing why it’s important. Here

are 5 things to consider:

1. You’ll

be able to meet your payroll.

I find this is one of the

biggest worries of smaller businesses. If you employ less than 25 people

there probably have been times when you were worried about having enough money

to meet payroll.

This is not an unusual

situation. Most smaller business owners I’ve talked with tell me that

from time to time they are really worried about meeting payroll.

Sometimes they even stop paying themselves.

This problem is always caused by

new sales drying up. If you spend 20% of your time creating new business

you’ll have enough business in your pipeline at all times. You might even

get to stop worrying about not meeting payroll.

2. New

customers are more profitable than old customers.

Old customers just don’t make

you as much money as new customers do. You might not increase prices

charged to your older customers. Old customers often aren’t getting

leading edge projects. Old customers might even start thinking of your products

as commodities.

New customers will buy your

latest and greatest. New customers will value what you do. New

customers will often pay you more than old customers for the same products.

The trick is to not only get

new customers, but to have your old customers think of you as a new

supplier. This will help you keep all your customers profitable.

3. Customers

are going to leave your company.

Customers go away.

Sometimes they go out of business, sometimes they sell their businesses and

sometimes they decide they want to use a different supplier. If you don’t

have a pipeline of new customers to replace the ones that go away you’re going

to have less business.

Having a new stream of sales

prospects allows you take the loss of customers in stride. It’s tough to

lose a customer. If you have new customers you’re working on the ones

that slide away won’t hurt as much.

If you spend 20% of your time

scouting for new customers you probably won’t have to worry about losing the

few that disappear. You must plan for some reduction in your customer

base every year. If you don’t have a way to replace them, eventually

you’re going to have problems with cash flow.

4. You’ll

have created a strategy for creating new sales.

Sales is hard work. Most

small companies just use brute force to get new business. They just make

calls and hope that good things happen.

Marketing is the strategic side

of sales. If you spend 20% of your time making sales calls you’re going

to get tired of having doors slammed in your face. You’ll probably find

ways to get better results. This is called marketing. Marketing is

all about strategy. Spending time working on new business every week will

automatically help make you a marketing whiz.

5. You’ll

start to learn about the difference between sales and marketing.

Sales and marketing are two

very different activities. Sales is all about tactics and marketing is

all about strategy. I recommend that you first start spending your 20% of

your time on marketing and then start selling.

Once you’ve put together strategies

for selling, use those strategies for the 20% of your time you spend on

sales. If you first plan how you’re going to be successful you’ll likely

be more successful. It’s very simple, but few people actually start with

marketing. You can be different and get better results just by making

this change.

If you want your company to

prosper you have to make sales and marketing part of your week, no matter how

busy you get. I know that you’ll be tempted to put sales on the back

burner when you get busy. If you do, just know that there will be a time

when your business slows down. Is this something you want?

Friday Feb 21, 2014

(Article) Prevention is Better Than Cure - Bill Black

Friday Feb 21, 2014

Friday Feb 21, 2014

To grow a valuable business – one you can sell – you need to set up your company so that it is no longer reliant on you. This can be easier said than done, especially when, like a PR consultant or plumber, what you are selling is your expertise.

To

scale up a knowledge-based business, you first have to figure out how to impart

your knowledge to your employees, so that they can deliver the goods. However

it can be difficult to condense years of school and on-the-job learning into a

few weeks of employee training. The more specialized your knowledge, the harder

it is to hand off work to juniors.

The

key to scaling up a service business can often be found by offering the service

that prevents customers from having

to call you in the first place. You have to shift from selling the cure to

selling the prevention.

Fixing

what is broken is typically a hard task to teach; however, preventing things

from breaking in the first place can be easier to train others to do.

For

example, it takes years for a dentist to acquire the education and experience

to successfully complete a root canal, but it’s relatively easy to train a

hygienist to perform a regularly scheduled cleaning.

It’s

almost effortless for a real estate manager to hire someone to clean the eaves

trough once a month, but repairing the flooded basement caused by the clogged

gutters can be quite complex.

For

a master car mechanic, overhauling an engine that has seized up takes years of

training, but preventing the problem by regularly changing a customer’s oil is

something a high school student can be taught to do.

For

an IT services company, restoring a customer’s network after a virus has

invaded often takes the know-how of the boss, but preventing the virus by

installing and monitoring the latest software patches is something a junior can

easily be trained to do.

When you’re selling your expertise, it can be tough to hire a team to do the work for you. As ironic as it sounds, sometimes the key to getting out of doing the work is to offer a preventive service, which not only maintains your business income, but also eliminates the need for someone to call you in the first place.

Thursday Feb 20, 2014

(Article) Owner Disability and Other Lifetime Transfer Events - Bill Black

Thursday Feb 20, 2014

Thursday Feb 20, 2014

When co-owners are united in striving toward common business goals such as growing revenue, building business value and increasing cash flow, the business dynamics can be wonderfully positive and strong. These owners move together to reach common goals. Contrast that bright picture with what can happen when, suddenly perhaps, the goals of the owners diverge.

Most closely held business owners are full-time employees (and more) in their businesses. What happens when one of the owners wants or needs to leave the company?

Possible reasons for leaving are many, ranging from boredom to more dramatic and unexpected events such as the sudden disability of an owner. Let’s use owner disability to illustrate some of the significant issues raised when ownership goals are no longer aligned.

When disability strikes an owner, the company will endure substantial hardships, both economic and operational. More importantly, in the absence of a buy-sell agreement, the disabled owner’s income stream from the company also may evaporate. This problem confronted Steve Hughes, one of three equal shareholders in a growing advertising agency.

At age 38, Steve suddenly had a stroke. As with many stroke victims, his recovery was incomplete. Physically, he was the picture of health (his golf game even improved!); but he totally lost his ability to speak and read. Doctors told Steve he would never be able to return to work.

Steve’s firm had a buy-sell agreement, but it covered only a buyout at death and an option for the company to buy Steve’s stock if he were to try to sell it to a third party. Trying to find and sell closely held stock to a third party is a difficult proposition anytime; Steve’s disability made it impossible. Even if his fellow shareholders had wanted to continue his salary, they did not have the resources to do so indefinitely.

As a result, the company and Steve were left in a classic dilemma—the company, or rather the remaining shareholders, wanted to purchase Steve’s stock so that its future appreciation in value, due now to their efforts alone, would be fully available to them. Conversely, as Steve’s family soon realized, the owners of closely held stock rarely receive current benefits in the form of dividends. The profits of a closely held corporation are either accumulated by the company or distributed to the active shareholders in the form of salaries, bonuses and other perks.

In short, Steve’s family would not get what it needed most—cash—to replace the salary Steve was no longer earning. Steve’s partners faced the prospect that their efforts to increase the value of the business would reward Steve as much as themselves.

This dilemma could be solved only by a buyout of Steve’s stock. His family then could receive a fair value for his business interest when they otherwise would receive nothing (until the company was eventually sold or liquidated). Meanwhile, ownership would be left with those responsible for the company’s success.

The Hughes buyout faced several problems arising from the now-divergent goals of the owners. Prior to Steve’s unexpected disability event, joint contributions of time, effort and capital created unanimity among owners. Now, one owner needs cash, while the company and the other owners want to retain earnings for growth.

Further, the remaining owners want to pay as little as possible over as long a time period as possible because they (or the company):

- Will pay for acquiring that value with after-tax dollars; and

- Want to preserve, not spend, capital on a non-productive asset such as stock of the company.

Before Steve’s stroke there was mutual agreement and understanding among the owners. After his disability, there are radically different owner wants and needs. The result: Owner discord and impaired business performance.

Typically, we must address four major issues that arise in situations like this:

- Agreement on the business value.

- Funding for the buyout.

- Agreement on the payment terms of the buyout.

- Payment to the departing owner with the least income tax consequences.

A buy-sell agreement drafted before such transfer events occur and when mutual ownership objectives unite all owners can anticipate and manage each of these issues.

If you would like to discuss in more detail ways to prevent problems in a transfer of ownership, please contact me.

Wednesday Feb 19, 2014

(Article) Key Considerations Regarding Business Real Estate - Aaron Weiner

Wednesday Feb 19, 2014

Wednesday Feb 19, 2014

There are

many things in the bundle when you package your business for sale besides your

financial bottom line. There is your

company’s goodwill and your company’s facilities whether they be leased or

owned. In both instances, your physical

plant – be it warehouse, office, or retail – is a reflection on your company. Be mindful to make them a valuable asset in

the sale package, not a liability.

Here are a

few key precepts to keep in mind when you make key real estate decisions

leading up to the eventual disposition of your company:

·

Remember that the image of your building

reflects your company’s culture and makes a major impression on your employees

as well as your visitors – or potential buyers

·

Be sure to negotiate the transferability of any

lease renewal options

·

Make sure the building you occupy is efficient

and functional for your business operations.

·

Keep the Permitted Use language flexible to keep

your future options open.

Avail

yourself of the services of a competent commercial real estate broker who will

help you plan for these and many other critical considerations that affect your

bottom line.

Tuesday Feb 18, 2014

(Article) Is Your Team In Place And Playing Like One? Scott Donnelly

Tuesday Feb 18, 2014

Tuesday Feb 18, 2014

This brief article is from Scott Donnelly, CPA & Partner, PDM, LLP. Scott was previously interviewed by Bill Black, The Exit Coach, on The Exit Coach Radio Show - the Information Station for Age 50+ Business Owners contemplating Business Succession and Exit Planning.

To listen to other content by Scott - See the "ADVISOR INDEX" on right from the Home Page.

PDM CPAs maintains

long term professional relationships with many of our clients. A key to our

success is ensuring our clients have the right team at our firm as well as

other appropriate consultants. We meet

with our prospective clients to determine what their needs are and also gain an

understanding of why they are changing CPA firms. We also want to maintain open communications

with our clients other consultants such as attorneys, financial planners and

bankers. A key to a successful business

plan and succession planning is maintaining a team of competent

professionals. Our clients success is

our success.

Monday Feb 17, 2014

(Article) Owner Preparation for a Future Exit (Part 3) - Louis Tucci

Monday Feb 17, 2014

Monday Feb 17, 2014

The following is the third of a 3 part article by Louis Tucci of L. Tucci Financial LLC.

You can hear his full 20 minute interview here at www.ExitCoachRadio.com tomorrow, Tuesday, 2/18

Developing A Succession Playbook

To assist you in your planning, we recommend writing a succession playbook. Begin by listing every key stakeholder to the business who will be affected by your exit and the impact that the exit has on each person or association. It has been said, “You cannot manage that which you cannot measure,” therefore, taking stock and measurement of those affected by your eventual departure is an important component of coming to grips with the changes the company will face.

Tipping the First Domino – Getting the Process Started

Eventually, when the initial planning is complete, your outside advisors and internal managers are aligned with your thinking and when it comes time to execute, you will need to begin the communication process. We recommend that you organize / schedule the initial conversations with your top managers first in order to gain consensus at the top of your organization. After their questions are asked and answered, it will get progressively easier to communicate both down the employee list as well as to outside parties.

Concluding Thoughts

Succession planning is not an easy task and it is not something you do overnight. There are many moving parts involved with passing the torch, but with the proper succession team and transition planning, you can alleviate many of the headaches associated with this life-changing event. Start planning early; be mindful when considering the impact on your employees, customers, business relationships and vendors; develop a team of individuals who you trust to guide you through the process; have a clear and concise communication plan ready to roll out; and, develop a succession playbook. Having these tools in place will help to eliminate an environment of instability and will provide ease-of-mind as you move on to your future endeavors.

L. Tucci Financial LLC

Louis Tucci

310 Passaic Ave.

Ste 203

Fairfield, NJ 07004

973-582-1003

ltucci@financialprinciples.com

www.ltuccifinancial.com

Securities offered through Securities America, Inc., A Registered Broker/Dealer, Member FINRA/SIPC. Neither Forefield Inc. nor Forefield AdvisorTM provides legal, taxation or investment advice.

All the content provided by Forefield is protected by copyright. Forefield claims no liability for any modifications to its content and/or information provided by other sources.

Sunday Feb 16, 2014

(Article) Owner Preparation for a Future Exit (Part 2) - Louis Tucci

Sunday Feb 16, 2014

Sunday Feb 16, 2014

The following is the second of a 3 part article by Louis Tucci of L. Tucci Financial LLC.

You can hear his full 20 minute interview here at www.ExitCoachRadio.com on Tuesday, 2/18

Anticipating the Needs and Concerns of Others

We know that anticipating the needs of others has a positive effect on the overall success of a business. To help alleviate the stress and anxiety associated with making this decision, it is useful to anticipate the concerns and needs of others by preparing in advance. One way to do this is by using an outside advisor or team of advisors to guide you through transition planning before turning to ‘insiders’, i.e. those closest to you in the business.

The Use of Outside Advisors in the Early Stages of Planning

Planning an exit or a succession of your business is a lonely task at best. Having access to a team of experienced and objective external advisors can be very helpful during the initial planning stage. While it might be tempting to look within the organization for guidance and assistance, keep in mind that core employees and/or insiders generally lack the experience needed for this type of planning. In addition, you will also want to give careful consideration to the inherent conflict of interest that exists with insiders / managers, as they are likely to consider the impact that these changes will have on them personally, making it difficult to provide you with completely objective and unbiased advice.

How and When to Bring Insiders into Your Circle of Trust

After an initial stage of planning, where you get educated on the exit options and begin the process of executing on your strategy, you will eventually need to bring specific members of your leadership / management team into the planning process. Determining who to trust (as one of your insiders) and who will be the best and most effective advisors, can be a challenging task and careful consideration and thoughtfulness is in order.

As a general rule, you want to begin with one or two trusted insiders who are working at a strategic level with you in the organization. It is expected that these senior managers can understand what you are sharing and, perhaps, even see the benefits of future ownership of the business in new hands.

An Internal Communications Plan

In any business scenario or situation, communication is a critical component and a key to success. Without clear and concise communication, outsiders (and insiders alike) may begin to speculate or fret over what the future holds. No matter the level of internal input or consensus achieved, it pays to develop a detailed list of all individuals directly impacted by the eventual succession and exit.

For some folks, the owner’s exit may mean a promotion and/or greater responsibility. For others, having the owner move on may mean the end of their employment within the company. In some cases – where the owner manages key relationships to the enterprise – a tailored communication plan is necessary to assure relationships will remain intact and not be damaged through the succession.

The process of detailing the anticipated impact on each of these individuals is hugely valuable to owners and helps them think through the likely scenarios where others will feel the change. Having a documented “Succession Playbook,” which considers all possible scenarios, adds a dimension of organization and planning to this process which should help you, the owner, get a higher level of comfort with this inherently challenging task of communicating change through the organization.

L. Tucci Financial LLC

Louis Tucci

310 Passaic Ave.

Ste 203

Fairfield, NJ 07004

973-582-1003

ltucci@financialprinciples.com

www.ltuccifinancial.com

Securities offered through Securities America, Inc., A Registered Broker/Dealer, Member FINRA/SIPC. Neither Forefield Inc. nor Forefield AdvisorTM provides legal, taxation or investment advice.

All the content provided by Forefield is protected by copyright. Forefield claims no liability for any modifications to its content and/or information provided by other sources.

Saturday Feb 15, 2014

(Article) Owner Preparation for a Future Exit - Part 1 - Louis Tucci

Saturday Feb 15, 2014

Saturday Feb 15, 2014

|

The following is the first of a 3 part article by Louis Tucci of L. Tucci Financial LLC. Owner Preparation for a Future

Exit

L. Tucci Financial LLC Louis Tucci

Securities offered through Securities America, Inc., A Registered Broker/Dealer,

Member FINRA/SIPC. Neither Forefield Inc. nor Forefield AdvisorTM provides

legal, taxation or investment advice.

|

Friday Feb 14, 2014

(Article ) Is Your Company Worth All It Could Be Worth? Kevin Walker

Friday Feb 14, 2014

Friday Feb 14, 2014

Boardwalk

Brand Strategy and Development

661-299-9277 x 801

kevin@boardwalkla.com

http://boardwalkla.com

Saturday Feb 08, 2014

(Article) Equality and Fairness in Transfers to Kids - Bill Black

Saturday Feb 08, 2014

Saturday Feb 08, 2014

Stan Briggs was perplexed when he told his advisor, “My son, Patrick, has worked in the business for the last twelve years. In that time, the business has tripled its revenues and its profits. I’ve started to think about scaling back my activity and I realize how important it is (for my own retirement income) that Patrick be motivated to continue to grow the company profitably. Since I’d like to have him own the business someday, is there a way to start transferring it to him now? It seems unfair to make him pay for all of the business value since he created so much of it and since he is so important to my financial security. My son, of course, agrees wholeheartedly with this analysis but I’m not so sure that his mother and sister are on the same page. What issues do I need to consider?”

Equal vs. Fair

First, Stan must determine if his son is already paying for the business through “sweat equity” (more working hours, greater risk and lower compensation than he could have earned elsewhere). If so, any reduction in the purchase price is not a gift, but rather recognition of Patrick’s contribution.

Second, are Patrick's efforts adding value to the business? If so, should Patrick have to pay for his efforts by receiving a reduced share of Stan’s ultimate estate?

Third, if Patrick’s involvement in the business is critical to Stan’s retirement, Stan should consider tying his son to the business using “golden handcuffs,” such as awarding ownership if Patrick stays to run the business—and the business stays profitable.

Fourth, in many business-owning families, every child is offered the opportunity for involvement in—and ultimately ownership of—the family business. Many times, however, only one child forgoes the allure of the “outside world” to commit to working in the sometimes uncertain and illiquid world of a closely held business. (Not to mention that having you for a boss should have some payoff!)

Lastly, analyze the transfer issue in light of your own goals. Be certain that any transfer to children will satisfy your exit objectives. Explore with your advisors other issues and concerns that may arise as you begin to transfer ownership to a child. For example, how much money will you need after you leave your business? What, if anything, needs to be done for your key employees or for your other children? Temper and qualify all transfers to children in light of your over-arching exit objectives. In short, make certain the transfer of ownership to a child is also a good business and retirement decision.

Using Advisors

When considering a transfer of your business to a child, don’t underestimate the value of using experienced consultants and advisors. Their counsel, experience and input are perhaps never more important than when dealing with your own family. The need for independent, non-emotionally-charged advice can be critical. Having worked with other family businesses, these consultants along with your other advisors can offer practical advice.

Decision Framework

- First determine the level of contribution your business-active child has made to the value of the business.

- Second, determine the contribution that child must continue to make to ensure the achievement of your exit objectives. Those determinations can form the basis of what is “fair” with respect to both the business-active child and the other children.

- Third, use your advisors to help explain, guide and implement the transfer of the business.

We are happy, as always, to assist you with analyzing the issues involved with a transfer of ownership to children.

Subsequent issues of The Exit Planning Review™ provide balanced and advertising-free information about all aspects of Exit Planning. We have newsletter articles and detailed White Papers related to this and other Exit Planning topics. For more info , contact me at billblack@exitcoach.biz

Tuesday Feb 04, 2014

(Article) Use Quick Ratio for a Strength Test - Dave G

Tuesday Feb 04, 2014

Tuesday Feb 04, 2014

Does your

intuition tell you that the firm may be a little cash strapped? Have your CFO give you a current Balance

Sheet and do a Quick Ratio.

A Quick

Ratio is taking your current cash (bank) balance(s) and add to it the total

Accounts Receivables. (Be sure to deduct all receivable over ninety days,

because these accounts are clearly a collection issue). Divide the Cash &

Accounts Receivable total by your Total

Current Liabilities! This is a good

indicator of liquidity, although by itself it is not a perfect one. The higher

the number the stronger the company.

Dave “G”

Sunday Feb 02, 2014

Sunday Feb 02, 2014

Tips to Get the Most Out of your Employees -- Your Human Capital

by Linda Duffy

1.

Think of your employees or human capital and make sure you’re getting

your return on your asset or investment. Your employees may be assets that go

home every night, and for most companies, payroll is the largest line item in

their budget. Unlike most assets that depreciate over time, your human capital

appreciates in value. Employees acquire new knowledge, skills, and abilities,

and they have tribal or organizational knowledge that takes time to replace.

Make sure you’re measuring the ROI or ROA of your human capital. Choose

appropriate metrics for your industry and organization and just start

someplace. Choose simple metrics at first such as (a) revenue per employee or

payroll dollar; (b) error rates; and (c) productivity per employee.

2.

Train your managers! The Gallup Organization has done extensive

research regarding employee engagement. They found that the number one reason

employees leave their employers is NOT compensation, but because of their boss!

After surveying millions of employees worldwide, they also found that only 30%

of employees are actively engaged at work, 50% of employees are not engaged,

meaning they’re just kind of hanging out, and the other 20% are actively disengaged,

meaning they’re toxic and spreading discontent.

Managers need to be equipped to manage employees, including how to identify top

talent, develop talent, motivate employees, and provide effective feedback.

Many managers are promoted because they were the best worker, not because they

have management skills. When people are promoted into management roles and not

provided training, 40% fail within the first 18 months. So, the most important

decision you can make to improve your organization is to hire and develop great

managers.

We focus them on the actual deliverables for the position that will support the company’s overall strategic objectives. We then develop what we call a Success Profile, and listeners can download samples from the Resources page of ethoshcs.com. For example, we’re doing a search right now for a National Sales Manager for a manufacturing company. In order to be successful, the new manager must develop a strategic plan to support 40% revenue growth, broken down by industries and territories. In the first 60 days, the manager must drive the implementation of a CRM software tool. And so on… There are actually 11 deliverables for that position in the first year.

What’s great about this process is that everyone has absolute clarity about what is expected, so it dramatically increases the success rate in hiring. That Success Profile becomes the basis for how we source and recruit candidates; the candidates love it because either the job excites them or they simply self select out of the process; and hiring managers love it because they have a performance management tool once the new hire starts.

Listen to other content by Linda - See the "ADVISOR INDEX" on right from the Home Page

Or listen to our many other top Advisor Guests' 20 MINUTE INTERVIEWS and 1 MINUTE AUDIO TIPS

To get updates on new content and a Weekend Summary , text "EXIT" to 22828 or CLICK HERE

We have over 125 Advisors booked and we add new content daily, so come back often!

Please mention Exit Coach Radio to your friends!

ExitCoachRadio.com - Come Listen for a Minute!

Sunday Feb 02, 2014

Transition Choices -- Paul Cronin

Sunday Feb 02, 2014

Sunday Feb 02, 2014

1. You are GOING to leave your business someday. You only have two choices for transitioning:

a. Plan your transition on YOUR terms

b. Let OTHERS plan it FOR you (i.e., family, governments, courts, lawyers, etc.)

2. Most business owners think of retirement as one of two choices:

a. Die at their desk (because they can’t think of anything more meaningful to do)

b. Retire to a boring, meaningless life (i.e. “The Golden Years” our grandparents retirement)

i. We say: no there is a third choice – The Platinum Years℠, a dynamic life, full of purpose and meaning, the best 10,20 or 30 years of life

3. Leaving your business is NOT a “Do It Yourself” project. Depending on the size of your business, you will need at least 4 and as many as 17 different advisors

a. Why? Because the skills and knowledge you have gained to start and run your business, are NOT the same skills and knowledge that you need to leave your business, and you don’t have 20 years to learn them all

Successful Transition

Planning Institute

Paul

F. Cronin

Andover,

MA

978-749-9546

978-697-4380

(cell)

paul@thenexttransition.com

Google+: pfpcronin

Linked-In:

paulfcronin

Wednesday Jan 15, 2014

What Is Exit Planning? - John Brown

Wednesday Jan 15, 2014

Wednesday Jan 15, 2014

Definition of Exit Planning: Exit Planning is the comprehensive approach to designing an exit strategy from a business.

It encompasses setting exit objectives (When does the business owner want to leave? To whom will he or she sell the business? etc), pulling together a team of trusted, professional advisors (a CPA, an Attorney, a Financial Advisor, etc) to participate in developing planning ideas and writing down each aspect of the transition sequence in the form of a Road Map that explains exactly what steps will be taken, when and why.

From Business Enterprise Institute Founder, John Brown

To hear John's full interview, and 1 minute highlights, check his folder under "index" at www.ExitCoachRadio.com - Come listen for a minute!

Thursday Dec 26, 2013

A Quick Word About Why We Do What We Do - Bill Black

Thursday Dec 26, 2013

Thursday Dec 26, 2013

NOTE: THE VIDEO MAY TAKE A MINUTE TO LOAD - CLICK "PLAY" AND "PAUSE" WHILE YOU READ THIS AND IT WILL PLAY SMOOTHLY

In this brief video, we spell out what we do and why we do it. We are here to help our community of listeners to learn as much as possible from as many people as possible about a variety of topics. When you look at the topic of Exit & Succession Planning, you need to (a) Set Goals about Timing, Treasure and Target, (b) Assess your strengths and weaknesses, (c) create an action plan (d) assemble and coordinate your team and (e) execute the strategies in a prioritized order.

But first it helps to get ideas, strategies, tips, precautions. So we have lined up over 90 Top Advisors in the fields of Law, Accounting, Valuation, Management, Operations, Insurance, and Mergers & Acquisitions to talk to you, here -- every day we will load new, fresh, relevant content.

In 2014 we will add in additional content, such as Webinars, Surveys, Assessment Tools and Checklists -- so you can be well-planned!

So JOIN US for a minute a day -- and tell your friends -- it's more interesting when you learn together!

Happy Holidays, and Happy New Year,

From The Exit Coach Radio Show

Bill Black

Wednesday Dec 25, 2013

Light Reading - Stuff You Didn't Know You Didn't Know!

Wednesday Dec 25, 2013

Wednesday Dec 25, 2013

print than women can; women can hear better.

------------

--------- --------- ---------

--------- --------- ---------

It is impossible to lick

your elbow.

------------

--------- --------- ---------

The State with the

highest percentage of people who walk to work:

Alaska

------------

--------- --------- ---------

The percentage of

Africa that is wilderness: 28%

(now get this...)

------------

--------- --------- ---------

The percentage of

North America that is wilderness: 38%

------------

--------- --- ------ --------- --------- --------- ---------

------

The cost of raising

a medium-size dog to the age of eleven:

------------

--------- --------- --------- --------- --------- ---------

The average number

of people airborne over the U.S.

61,000

------------

--------- --------- --------- --------- --------- ---------

Intelligent people

have more zinc and copper in their hair..

------------

--------- --------- --------- --------- --------- ---------

The first novel ever

written on a typewriter, Tom Sawy er.

------------

-- ------------ --------- --------- --------- ---------

The San Francisco

Cable cars are the only mobile

------------

--------- --------- --------- --------- --------- ---------

Each king in a deck

of playing cards represents a great king from history:

------------

--------- --------- --------- --------- --------- ---------

------

111,111,111 x

111,111,111 = 12,345,678,987, 654,321

------------

--------- --------- --------- --------- --------- ---------

If a statue in the park of a person on a horse

has both front legs in the air, the person died in battle.

If the horse has one front leg in the air,

the person died because of wounds received in battle.

If the horse has all four legs on the ground, the person died of natural causes

------------

------ --- --------- --------- --------- --------- ---------

Only two people

signed the Declaration of Independence on July 4,

------------

--------- --------- --------- --------- --------- ---------

Q. Half of all Americans live within 50 miles of what?

------------

--------- --------- --------- --------- --------- ---------

Q. Most boat owners name their boats.

Obsession

------------

--------- --------- --------- --------- --------- ---------

Q.. If you were to spell out numbers,

would find the letter 'A'?

------------

--------- --------- --------- --------- --------- ---------

Q. What do bulletproof vests, fire escapes,

by women.

------------

--------- --------- --------- --------- --------- ---------

Q. What is the only

food that doesn't spoil?

------------

--------- --------- --------- --------- --------- ---------

Q. Which day are there more collect calls

------------

--------- --------- --------- --------- ---------

In Shakespeare's time,

When you pulled on the ropes, the mattress tightened,

making the bed firmer to sleep on. Hence the

phrase...'Goodnight , sleep tight'

------------

--------- --------- --------- --------- --------- ---------

It was the accepted

practice in Babylon 4,000 years ago that for a month after the wedding, the bride's father would supply

------------

--------- --------- ---------

In English pubs, ale

is ordered by pints and quarts... So in old England , when

customers got unruly, the bartender would yell at them 'Mind your pints and quarts, and settle down.' . . .

the phrase 'mind your P's and Q's'

------------

--------- --------- ---------

Many years ago in

England , pub frequenters had a whistle baked

------------

--------- --------- ------ --- --------- --------- ---------

At least 75% of

people who read this will try

------------

--------- --------- --------- --------- --------- ---------

enter your PIN on the microwave.

played solitaire with real cards in years.

don't have e-mail addresses.

to notice there was no #9 on this list.

------------

--------- --------- --- ------

Please share this

with your friends. You know you want to!

Listen to our many top Advisor Guests' 20 MINUTE INTERVIEWS and 1 MINUTE AUDIO TIPS

To get updates on new content and a Weekend Summary , text "EXIT" to 22828 or CLICK HERE

We have dozens of Advisors booked and we add new content daily, so come back often!

Please mention Exit Coach Radio to your friends!

Wednesday Dec 25, 2013

A Christmas Holiday Greeting

Wednesday Dec 25, 2013

Wednesday Dec 25, 2013

CLICK HERE

Saturday Dec 21, 2013

The Importance of Financial Statements in the Exit Planning Process - Bill Black

Saturday Dec 21, 2013

Saturday Dec 21, 2013

Wednesday Dec 04, 2013

It's 2013 - Update Your Marketing Efforts - Jonathan Boring

Wednesday Dec 04, 2013

Wednesday Dec 04, 2013

A great tip from Jonathan Boring of Social Spice Media - (look for his other 1 minute audio tips in the INDEX from his past interview):

Social Spice Media wants to remind you that only 14% of the American public believe traditional advertising such as TV commercials, Banner ad’s, newspapers and radio commercials; whereas over 87% of the American public believe recommendations from their friends, neighbors and co-workers!

Stop throwing your marketing dollars down the drain with yet another direct mail campaign or banner ad that is not delivering the ROI you are looking for, and start using Social Media Marketing to help grow your business!

The Exit Coach Radio Show - the Information Station for Baby Boomer Business Owners contemplating Business Succession and Exit Planning.

Listen to other content by this advisor - See the "ADVISOR INDEX" on right from the Home Page

Or listen to our many other top Advisor Guests' 20 MINUTE INTERVIEWS and 1 MINUTE AUDIO TIPS

To get updates on new content and a Weekend Summary , text "EXIT" to 22828 or CLICK HERE

We have dozens of Advisors booked and we add new content daily, so come back often!

Please mention Exit Coach Radio to your friends!